We thank the guys from zerohedge.com for this article!

We thank the guys from zerohedge.com for this article!

Make sure you visit them today to learn more…

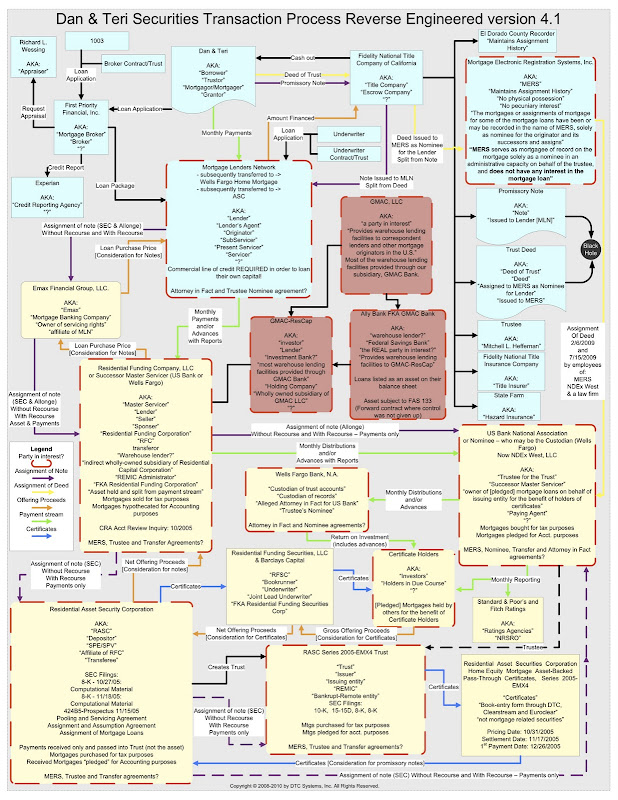

Just When You Thought You Knew Something About Mortgage Securitizations

Dan Edstrom is a guy who is in the right place at the right time.

His profession? He performs securitization audits (Reverse Engineering and Failure Analysis) for a company called DTC-Systems.

The typical audit includes numerous diagrams including the following:

- Transaction Parties and Flow (similar to the chart below, but much easier to understand)

- Note exchanged for a bond Foreclosure parties

- Priority of Payments from the Security Instrument (Mortgage, Deed of Trust, Security Deed or Mortgage Deed)

- Priority of Payments from the Pooling and Servicing Agreement

This diagram shows that they are not following the borrowers instructions in the security instrument

Source of Payments for Distributions–This diagram is extremely complex and shows that the miscellaneous proceeds specified in the security instrument (and in the SEC Filings) should be applied to the sums secured by the obligation upon the event of a loss in value of the property, whether or not then due, with the remainder, if any, returned to the borrower. This document combines UCC 3-602(a), UCC 9-315, UCC 9-336, UCC 2-609, and UCC 3-501 together with NY Code Section 4545 and the SEC Filings to show that the miscellaneous proceeds can be applied to the borrowers obligation.

The following flow chart reverse engineers the mortgage on the Ekstrom family residence. It took Dan over one year to take it this far and it clearly demonstrates what happens when there are too many lawyers being manufactured.

Take a look at this chart and then decide how long you think it will take for Barney Frank and Eric Holder to sort everything out. There is a link to an expandable version at the end of this post.

Dan will be lecturing on this subject on December 11, 2010 if you are interested in learning more about who is the holder of your mortgage note. Here is the link to the Seminar:

and here is a link to a LARGE VERSION of the Chart:

What is important to see her is that every box at the end of the every arrow is making money off the homeowner, either charging a fee or getting a commission. Imagine how much more affordable home ownership will be if there were not so many “hands in the cookie jar”. It would be important to know what each “box” is making off each loan!?

Can DTC do this for individual borrowers? If so at what cost and how much time?

Please send me information to Track three Mortgages that are alledged in different MBS pools. MERS, BAC, and Recontrust, are common in all three forclosures. I have filed suits for wrongful forclosure and other Actions for all three properties. I have sent requests to SEC for Certified Docs. of all agreements pertaining to each mortgage with no response to date.

Thanks

Steve